Global Medium Density Fiberboard (MDF) Market (2019 – 2024)

Stringent government regulations are expected to hinder the growth of the market studied.

The furniture segment dominated the market in 2017 and is expected to expand at the fastest rate during the forecast period owing to the rapid growth in residential construction activities across the globe.

Growing residential construction in the Asia-Pacific Region is likely to act as an opportunity in the future.

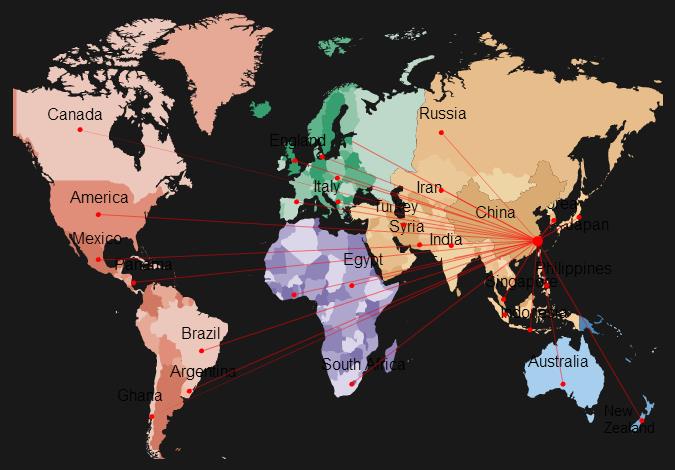

Asia-Pacific dominated the market across the globe with the largest consumption followed by Europe.

Scope of the Report

Medium-density fiberboard (MDF) or dry-process fiberboards have a fiber moisture content of less than 20% at the stage of forming and a density ? 450 kg/m3. These boards are essentially produced under heat and pressure, with the addition of a synthetic adhesive.

Key Market Trends

Residential- Fastest-growing end-user sector

MDF, due to its superior grade, is considered more stable than solid wood. MDF has better resistivity towards changes in heat and humidity, and is hence preferred for furniture, cabinetry, and flooring.

MDF is further used in decorative doors and panels, sculptures and moldings, beds, sofas, etc. Growing construction of residential projects all across the world is expected to drive the market for MDF through the forecast period.

India, China, and United States are expected to dominate the residential construction market through the forecast period.

In United States, the residential construction sector is expected to rise by around 6% in 2018, with construction for single-family expected to rise by 9% during the same year.

In India, new housing launches across top seven cities in the country increased by 27% year-on-year in January-March 2018, with further growth expected through the rest of the year, owing to the strong demand for residential construction. The housing sector in the country is expected to contribute around 11% to the country’s GDP by 2020. Additionally, continuous investments in the real estate sector is expected to drive the consumption of MDF in the residential sector in the country.

In Europe, Germany, which leads the construction sector in the region, is embarking on a new era of high-rise living. By 2018, around 9,770 apartments were built in 79 residential high-rise towers.

Overall, the booming residential market is expected to drive the use of MDF in the particular sector through the forecast period.

Asia-Pacific Region to Lead the Market

Asia-Pacific region dominated the global market share in 2017 holding a share of more than 60%. The increasing construction activities in China, South Korea, and Japan is boosting the demand for MDF in the region. China accounted for almost for more than 55% of the global share in 2017. The rapid growth in consumption of medium density fiberboard (MDF) in China has been majorly driven by the ample developments in the residential and commercial construction sectors, which are being supported by the growing economy. In 2018, the annual GDP growth rate of China grew by 6.6%. The GDP is further expected to record a growth of 6.1% in 2019 with the industrial and construction sectors accounting for approximately 50% of the GDP. The year 2016 was the first year of China’s 13th Five Year Plan. It was an important year for the country’s engineering, procurement, and construction (EPC) industry, as it ventured into new business models domestically and internationally. In 2017, China’s construction industry started recovering, due to the government’s push for construction investment as a means to sustain economic growth. Furthermore, Japan’s housing sector is expected to witness moderate growth, owing to the increased investments over the past few years. Japan spent USD 61 billion on infrastructure, in 2017. Increase in household spending has, in turn, increased the demand for remodeling of houses. The 2020 Olympics is expected to boost the new commercial construction in the country, and act as a major driver for the market studied.

Competitive Landscape

The market for global medium density fiberboard is highly fragmented in terms of production. The top three players account for more than 10% of the global market share. The major companies in the market include Kronospan, Arauco, Sonae Indústria, Duratex, and Swiss Krono.